I have always enjoyed tracking import numbers in Poland. It is a fun exercise to see which countries favor playing in Poland. Over the past 10 years, there have been a lot of changes in the numbers. For example, Russians used to make up the highest number of imports playing in Poland. After the Russian invasion of Ukraine, most teams committed to not signing Russian players. No Russian has played in the league since there were 40 during the 2022 season. In recent years, there has been a massive rise in the number of players from Finland and Sweden. The Finnish one makes sense with the large number of Fins brought in by Finnish head coaches. Now, thanks to word of mouth and the targeting of Mestis free agents by Polish clubs, the numbers are the highest ever. The new growth of Swedish players is a bit interesting, but it doesn’t seem to have a direct cause. From 2015 to 2022, there were never more than three Swedish players that played 5 or more games in the THL; the past two seasons saw 13 and 19 Swedes appear.

The biggest area of concern is the drop in Polish players. Obviously, limited and no import rules have had an impact on that. But is this a decline, a trend of Polish players disappearing, or is there more to it?

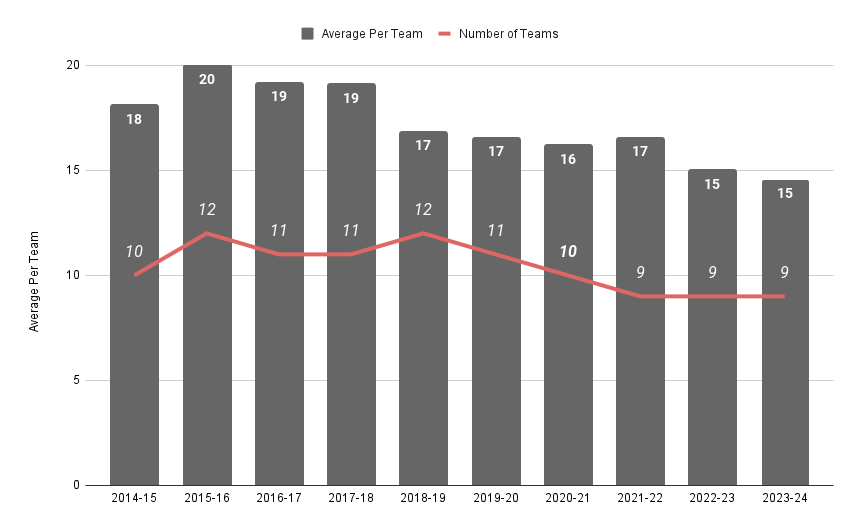

We have to look a bit deeper into the data. First, the number of teams in the THL has fluctuated yearly. Over the last ten-year span, the THL is at its lowest number of teams, at nine in the past three seasons. During the early part of our data, the league was either 11 or 12 teams in most seasons. One of the teams was usually either PZHL U23 or the SMS Sosnoweic U20 squad. This meant there was a team of nothing but young Polish players. Removing them obviously takes out a lot of native players. While the number of Polish players has declined, the amount per team is not that big of a decline.

We have only seen a slight decrease in the number of Polish players per team. We are likely looking at about 18 Polish players who lost their spots due to imports over the past two seasons. While it definitely sucks whenever Polish players lose their spots. For the health of the sport, it has to happen. When the league introduces better players, it helps improve the rest of the Polish talent in the league, while a better product on the ice is better for fans. We wrote recently about the rise in attendance in the THL, which reflects this. The THL is on the much higher side when it comes to other European leagues but is somewhat in line with leagues in a similar tier.

So, when it comes to finding talent to supplement a team, where do Polish clubs look the most often? The leader of the group has become Finland! Poland’s top league has seen 30 or more Fins in the past two seasons. Mestis free agents, especially those with Liiga experience, have been coveted by Polish clubs. Following Finland, Sweden (19) and Czechia (18) are the next most popular. Czechia has been the most popular player in the past ten years, with an average of 25 players a year; no other country has an average of more than 14. Sweden is a new favorite, as from 2015-2022, only 11 Swedes total appeared in the league, while 32 have played in Poland over the past two years. American and Canadian numbers are the most inconsistent and seem to fluctuate year to year. Slovakia is the only other somewhat common country; they have ten players this year, slightly below their average of 12. Latvia and Ukraine also usually have 3 to 7 players yearly in the league. Despite being common foes, the league barely sees players from the United Kingdom, with the only player coming during the pandemic season.

To see the full import data sheet, consider subscribing to our Patreon! That and other materials to boost your knowledge of Polish hockey are available at the $3 tier, and you get to pick an article topic of your choice.

If you want to keep up with all the Polish hockey action, make sure to follow us on Twitter @PolandHockey, like our Facebook page, and add us on Instagram @PolishPuck_. Also, support us on Patreon to help keep the content flowing!

Leave a comment